A tax cut bill, House Bill 2284, proposed in the legislature was vetoed by Governor Laura Kelly on January 26th. This week, it is anticipated that Kansas Republicans will move to override the veto and pass the bill. While the majority of the bill is supported by both parties, the inclusion of a flat income tax rate has created division.

“It’s bad policy, it’s going to jeopardize us in the future, and we need to say no and then we can have an honest conversation about something that actually would have relief for working Kansans,” Senate Minority Leader Dinah Sykes said.

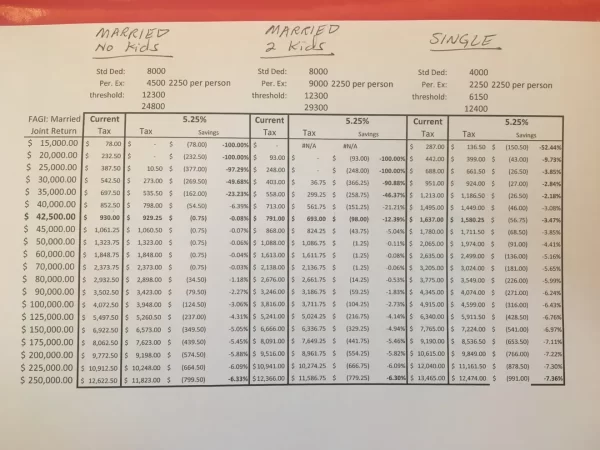

The proposed flat tax would eliminate the separation of three income groups currently taxed under Kansas law, setting a standard rate of 5.25%. Currently, Kansans are taxed 3.10% on the first $15,000 of taxable income, 5.25% on the next $15,000, and 5.70% on all income above $30,000. The flat tax would exempt taxes on income up to $6,150, or $12,300 for married couples filing together.

(PHOTO | Daniel Caudill)

“I can’t think of a more simple tax code,” Representative Adam Smith, chairman of the House’s tax committee, said. “If you disagree, I’d like to ask you, if this single-rate tax concept is okay for sales and property tax, why is it not also OK for income tax?”

Major criticisms of the flat tax include the lack of impact for the middle class and the disproportionate relief of high-income taxes. A study on the potential impacts of the proposal conducted by the Institution on Taxation and Economic Policy found that 44.5% of the income tax savings would go to the top 5% of wage earners.

“The public is the reason we have a progressive income tax,” House Minority Leader Vic Miller said.

The top 20% of earners would receive an average annual tax break of $828, while the bottom 80% of wage earners would receive an average annual tax break of $89 under the proposed flat tax. Defending these impacts, bill proponents claim that the tax breaks are proportional to the taxes paid, and so are higher for those paying more taxes.

“The highest income taxpayers pay approximately that 50% of the tax,” said Smith. “Any change you make to the tax code – they’re going to get a majority of that benefit because it’s proportional.”

Other vital elements of the package include abolishing the state sales tax on groceries in April, earlier than the currently planned date of Jan. 2025, removing taxes on Social Security income, reducing state property taxes, and tying the standard deduction to inflation.

“You can look at just one target of this and pick on that part of the bill,” Senator Caryn Tyson said. “But the overall bill is great policy for the average Kansas family.”

Bill 2284 would reduce State income by an estimated $1.6 billion over three years, with about $300 million of that reduction coming from the flat income tax. Of this $300 million, the majority of tax relief would go to Kansas taxpayers making more than $250,000., with about $40 million in income relief going to out-of-state residents.

“The people making between $50,000 and $100,000 get $20 million out of the $300 million,” Representative Tom Sawyer said. “That’s the big middle, the people in Kansas that work hard and pay their taxes. There are 300,000 people in that group.”

The tax cut is expected to receive the supermajority to bypass the Governor’s veto in the House of Representatives but still needs more votes in the Senate. One Senator, David Haley, has not yet declared which way he intends to vote.

“Those high-end earners… that would move… or be retained in our state… would that be able to offset… what those anticipated losses would be?” Haley said.

(PHOTO | Matthew Kleinmann)

Other economic arguments in favor of the flat tax rate site have cited studies showing that lowering a state’s top individual income tax rate causes various benefits for a state such as increasing in-state investment and spurring the growth of GDP, jobs, wages and inbound migration.

“A lower, flat income tax rate, combined with inflation indexing of the standard deduction and personal exemption, would do more to remove barriers to upward mobility in Kansas and provide greater tax savings to most Kansans over the course of their working lives,” Katherine Loughead, Senior Policy Analyst & Research Manager with the Center for State Tax Policy at the Tax Foundation, wrote in an article on the proposed flat tax.

Through the controversy, Republicans and Democrats have agreed that tax cuts are necessary in this legislative session. Regardless of the outcome, the vote for a supermajority on this veto will be close, and tax reforms will continue to be discussed.

“I never count my chickens before they hatch,” Kelly said. “But I am confident that we will be able to move on from the flat tax and have discussions about a much more sustainable, much more fair, tax structure going forward.”